From Debt to Dumbbells: Using Financial Freedom to Improve Health

Money and health are deeply connected, yet many of us treat them as completely separate parts of life. We spend years climbing out of debt, saving for the future, and working long hours to make ends meet—often at the cost of our physical and mental health.

But what happens when the burden of debt begins to lift? For many, financial freedom opens the door to better health. The energy once drained by financial stress can be redirected into exercise, balanced nutrition, and overall well-being.

This is the story of how moving “from debt to dumbbells” isn’t just about money—it’s about transforming your entire life.

The Link Between Money Stress and Health

Debt doesn’t just impact your bank account; it affects your body too. Research from the American Psychological Association shows that money is one of the leading causes of stress in the U.S.

Common health struggles linked to financial stress include:

- High blood pressure

- Poor sleep quality

- Weight gain or unhealthy eating habits

- Increased risk of anxiety and depression

- Less time and energy for exercise

When people are constantly worried about bills, workouts and meal planning often fall to the bottom of the priority list.

Breaking Free: Why Financial Freedom Improves Fitness

When you pay off debt or build financial stability, your mental and physical energy changes dramatically. Here’s why:

- Less Stress, More Energy

Without constant financial worries, your cortisol (stress hormone) levels drop—making it easier to sleep, recover, and stay motivated. - Time for Self-Care

No more endless side hustles or overtime just to pay bills—you can invest time in workouts, meal prepping, and rest. - Ability to Invest in Health

With more disposable income, you can afford a gym membership, better groceries, or a personal trainer if needed. - Confidence & Motivation

The discipline you used to pay off debt often transfers to building healthier routines.

👉 External Resource: APA – Stress in America Study

The Debt-to-Dumbbells Journey: Step by Step

Let’s break down how financial health and physical health can support each other in real life.

Step 1: Build a Strong Budget (Financial Warm-Up)

Think of budgeting as your warm-up routine—it prepares you for success.

- Track expenses like you track calories.

- Cut unnecessary “financial junk food” (impulse spending).

- Redirect those savings toward debt and health investments.

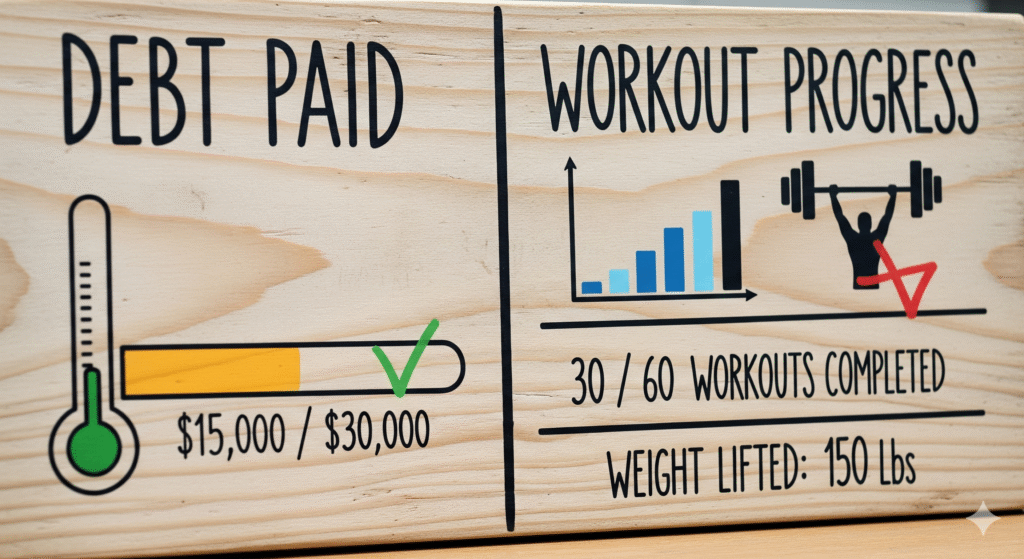

Step 2: Pay Off Debt (Building Core Strength)

Just as core workouts build stability, paying off debt gives you a strong financial base.

- Use methods like the Debt Snowball (start with smallest balances) or Debt Avalanche (start with highest interest rates).

- Celebrate each “debt rep” completed—it’s progress toward freedom.

Step 3: Redirect Funds to Health (Adding Weight to the Bar)

As debt payments shrink, redirect that money:

- Join a gym or buy dumbbells for home workouts.

- Switch from processed foods to fresh, nutrient-rich groceries.

- Try wellness tools (like yoga classes or meditation apps).

Step 4: Build Habits in Both Areas (Consistency Is Key)

Just as financial success requires consistency, so does fitness.

- Automate savings like you schedule workouts.

- Track progress in both fitness and finances.

- Stay patient—real transformation takes time.

Real-Life Example: John’s Story

John, a 35-year-old office worker, was buried in \$20,000 of credit card debt. Stress eating, sleepless nights, and no exercise became his norm.

After creating a strict budget, he started using the Debt Snowball method, and within three years, he was debt-free.

With extra cash and mental clarity, he joined a gym, hired a trainer, and lost 40 pounds. His confidence skyrocketed—not just because of his body transformation, but because he proved he could overcome obstacles in both money and health.

Tips for Using Financial Freedom to Improve Health

- Treat Health Like a Bill – Pay yourself first with workouts and nutrition, just like you pay rent.

- Invest in Long-Term Gains – Buy quality shoes, equipment, or a standing desk instead of temporary quick fixes.

- Stay Accountable – Use budgeting apps and fitness trackers for daily progress.

- Pair Rewards – Every debt milestone = a small health reward (new workout gear instead of a shopping spree).

- Focus on Sustainable Habits – Both finance and fitness are marathons, not sprints.

How a Lawyer-Turned-Yogi Found Balance in Fitness

Why Fitness and Finances Share the Same Principles

It’s no coincidence that financial success and physical fitness mirror each other. Both require:

- Discipline: Stick to the plan even when motivation fades.

- Consistency: Small daily habits compound into major results.

- Patience: True change takes months and years, not days.

- Mindset Shift: You need to believe long-term success is possible.

👉 External Resource: Investopedia – Financial Wellness

Final Thoughts

The journey from debt to dumbbells is more than a catchy phrase—it’s a roadmap to living a healthier, happier life.

When financial burdens disappear, you don’t just gain money—you gain time, energy, and clarity to take care of your body and mind. By channeling the discipline you used in your financial journey into fitness, you create a cycle of growth that benefits every part of your life.

So the next time you pay off a bill or knock out a workout, remember: both are victories in building freedom—the kind of freedom that lets you live fully.

FAQs About Money & Fitness

1. Can I focus on fitness while still in debt?

Yes! You don’t need expensive equipment. Start with bodyweight exercises, walking, or free resources online.

2. Should I pay off debt first or invest in health?

Do both in balance. Basic health (exercise, nutrition, sleep) should never be ignored, even while paying off debt.

3. How much should I budget for health after debt?

Start small—\$30–\$50 a month for gym or at-home equipment can be enough. Scale up as finances improve.

4. Can financial stress really affect my body?

Absolutely. Stress raises cortisol levels, leading to poor sleep, weight gain, and even heart problems.

5. What’s the biggest similarity between debt payoff and fitness?

Both require consistency and delayed gratification. Results compound over time.