How to Choose the Right Health Insurance for Cosmetic Surgery (2025 Guide)

Cosmetic surgery has become more common than ever, helping people boost their confidence, correct imperfections, or improve physical well-being. However, one major challenge remains — the cost. Cosmetic or elective procedures can be expensive, and not every insurance policy covers them.

The good news is that with the right approach and careful research, you can find health insurance plans that cover certain cosmetic or reconstructive surgeries, especially when deemed medically necessary.

This detailed guide will help you understand how to choose the right health insurance for cosmetic surgery, what’s typically covered, how to evaluate policies, and how to make informed, money-smart decisions about your health and beauty.

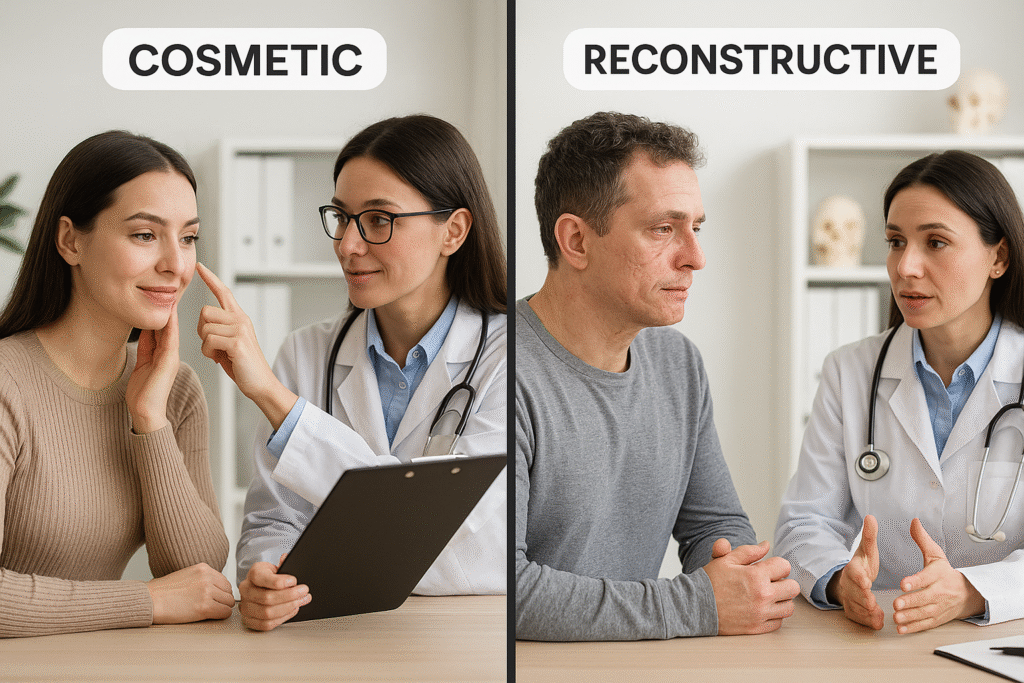

Understanding Cosmetic Surgery vs. Reconstructive Surgery

Before diving into insurance, it’s crucial to understand the difference between cosmetic and reconstructive surgery.

Cosmetic Surgery

Cosmetic surgery is performed to enhance appearance rather than to correct a medical issue.

Examples:

- Facelift

- Liposuction

- Rhinoplasty (nose reshaping for aesthetics)

- Breast augmentation

- Tummy tuck

These are typically not covered by insurance, since they are elective procedures.

Reconstructive Surgery

Reconstructive surgery, on the other hand, is performed to correct deformities caused by accidents, birth defects, or diseases.

Examples:

- Breast reconstruction after mastectomy

- Skin grafts after burns

- Rhinoplasty to correct breathing problems

- Eyelid surgery to improve vision

These are often covered partially or fully by many health insurance plans.

🏥 Why Insurance Coverage for Cosmetic Surgery Is Complicated

Insurance companies typically cover only procedures that are medically necessary. That means your doctor must provide documentation proving that the surgery isn’t purely for appearance but for health, function, or recovery.

Key factors insurers consider:

- Medical necessity (doctor’s recommendation)

- Severity of the condition

- Functional impairment caused by the issue

- Recovery outcomes

Example:

A breast reduction may be covered if large breasts cause chronic back pain.

A nose job (rhinoplasty) may be covered if it’s required to correct breathing issues, not just reshape the nose.

Step-by-Step Guide: How to Choose the Right Health Insurance for Cosmetic Surgery

1. Understand What’s Covered and What’s Not

Start by reading your health insurance policy’s coverage terms and exclusions. Most insurers list “cosmetic procedures” under exclusions unless they are medically justified.

Look for phrases such as:

- “Medically necessary reconstructive surgery”

- “Post-traumatic reconstruction”

- “Congenital defect correction”

If unclear, call your insurer and ask directly. Always request written confirmation of what’s covered.

Top Fitness Equipment You Can Finance with Low-Interest Loans

2. Get a Medical Assessment

Before applying for coverage, consult with your physician or surgeon. They can provide medical justification documents, including:

- Diagnosis reports

- Medical necessity letters

- Photos or X-rays (if required)

These are essential for insurance pre-authorization — a formal approval before surgery.

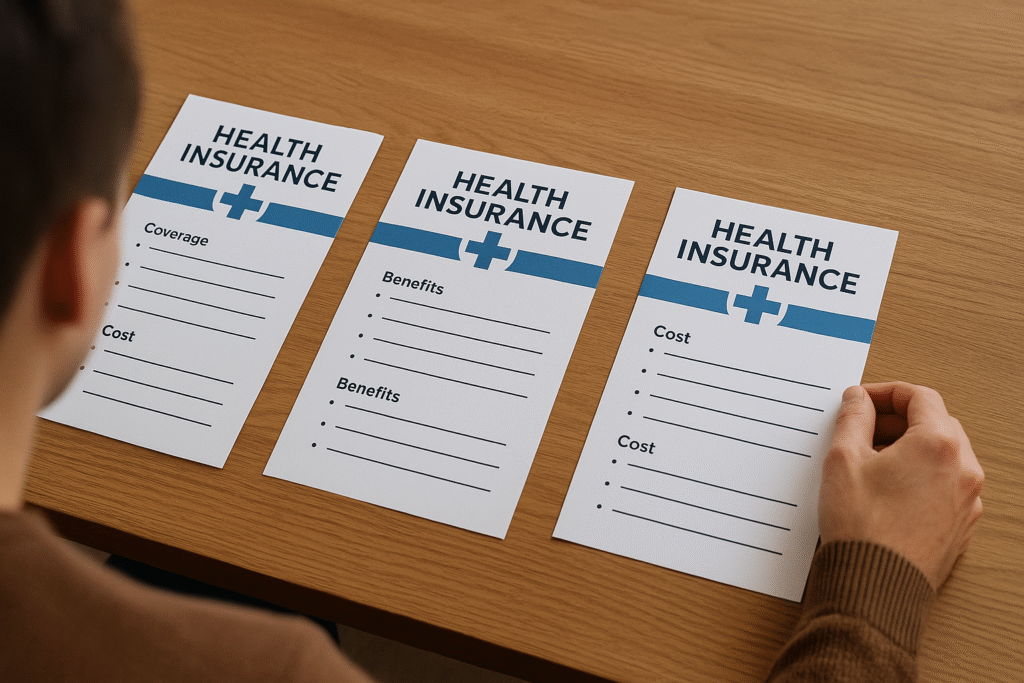

3. Compare Different Insurance Providers

When choosing insurance for cosmetic or reconstructive surgery, look for:

| Feature | Why It Matters |

|---|---|

| Coverage Flexibility | Some insurers offer add-on riders for specific cosmetic needs. |

| Pre-Authorization Process | Easier approval for medically necessary procedures. |

| Network Hospitals | Ensure your preferred surgeon/hospital is in-network. |

| Claim Rejection Ratio | Lower rejection rates indicate reliability. |

| Premium vs. Deductible | Balance between affordable premiums and realistic out-of-pocket costs. |

Top Insurers Known for Flexibility in Medical Procedures:

- Blue Cross Blue Shield

- Aetna

- Cigna

- UnitedHealthcare

- Kaiser Permanente

(Always verify coverage by location and plan type.)

4. Ask About Add-Ons or Specialized Coverage Plans

Some insurers allow optional add-on riders that can include elective procedures, post-surgery rehabilitation, or advanced hospital care.

If your current plan doesn’t offer coverage, consider:

- Supplemental Health Insurance: Adds extra protection for specific surgeries.

- Medical Loans or Health Financing Plans: Offered by some hospitals for elective cosmetic treatments.

5. Evaluate Out-of-Pocket Costs

Even if your procedure is partially covered, there may still be expenses like:

- Surgeon fees

- Anesthesia

- Post-operative care or physiotherapy

- Hospital stays beyond policy limits

Ask for a cost estimate and co-payment breakdown from both your doctor and insurer before committing.

6. Review Waiting Periods and Pre-Existing Clauses

Some insurers impose waiting periods before certain procedures are eligible for coverage—ranging from 1 to 4 years.

If your cosmetic or reconstructive surgery is due to a pre-existing condition (like birth defects or injuries), ask if the insurer covers it after the waiting period.

7. Get Everything in Writing

Always document every communication with your insurer. Request email or letter confirmations for:

- Coverage eligibility

- Pre-authorization approval

- Estimated claim amount

This avoids disputes during claim processing and ensures transparency.

💰 Financing Options If Insurance Doesn’t Cover It

If your insurance denies coverage for a cosmetic procedure, you still have options:

- Personal Health Loans – Many banks offer low-interest medical loans for elective procedures.

- Medical Credit Cards – Cards like CareCredit specialize in financing healthcare services.

- Hospital Payment Plans – Some hospitals offer 0% EMI options for selected surgeries.

External Resource:

🌿 Pro Tip: Choose an Accredited Surgeon & Hospital

Even if you find affordable insurance, prioritize board-certified cosmetic surgeons and accredited hospitals. This ensures:

- Higher safety standards

- Fewer complications

- Easier insurance claim processing

You can verify your doctor’s credentials via the American Board of Plastic Surgery (ABPS).

Final Thoughts

Choosing the right health insurance for cosmetic surgery requires time and research — but it’s absolutely worth it. By understanding what’s covered, getting proper documentation, and comparing providers, you can minimize financial stress and focus on recovery.

Remember:

“Good insurance doesn’t just cover your health — it protects your confidence, peace of mind, and future well-being.”

FAQs

1. Does health insurance cover cosmetic surgery?

Generally, no — unless it’s medically necessary (like reconstructive surgery).

2. What’s the difference between cosmetic and reconstructive coverage?

Cosmetic surgery enhances appearance, while reconstructive surgery corrects health-related or injury-based deformities.

3. Can I get health insurance that covers elective cosmetic procedures?

Some specialized insurers or private plans may include add-ons for elective surgeries, but they’re rare and more expensive.

4. How can I appeal an insurance claim denial?

Submit an appeal with supporting medical documentation from your doctor and a statement showing the procedure’s health necessity.

5. Is it better to use financing instead of insurance for cosmetic surgery?

If your insurer excludes it, financing or medical loans can be an affordable alternative—especially with 0% interest options.