Fitness And Tax Benefits: Can You Deduct Gym Memberships in 2025?

If you’re like millions of Americans spending hundreds or even thousands of dollars annually on gym memberships, you’ve probably wondered: “Can I write this off on my taxes?” It’s a fair question, especially when fitness expenses feel like a necessary investment in your health and productivity.

The short answer is: it depends. While most people cannot deduct gym memberships as a personal expense, there are specific situations where fitness-related costs may qualify for tax deductions. Understanding these nuances could save you money and help you make smarter financial decisions about your fitness investments.

In this comprehensive guide, we’ll explore when gym memberships might be tax-deductible, who qualifies, and what documentation you need to potentially claim these deductions.

The General Rule: Personal Gym Memberships Aren’t Deductible

Let’s start with the reality most people face. According to the Internal Revenue Service (IRS), gym memberships purchased for general health and wellness are considered personal expenses and are not tax-deductible for the average taxpayer.

The IRS distinguishes between expenses that maintain general health and those that treat specific medical conditions. Simply wanting to stay fit, lose weight, or feel better doesn’t qualify your gym membership for a tax deduction under standard circumstances.

This might seem frustrating, but there’s logic behind it. The IRS considers general fitness similar to buying healthy groceries or comfortable shoes—beneficial for your wellbeing, but not a deductible expense.

When Gym Memberships CAN Be Tax-Deductible

Despite the general rule, several legitimate scenarios exist where your fitness expenses might qualify for tax benefits. Here’s when you might be able to deduct your gym costs.

1. Medical Necessity with Doctor’s Prescription

If your doctor prescribes a specific exercise program to treat a diagnosed medical condition, your gym membership may qualify as a deductible medical expense. This isn’t about general wellness—it requires documentation of a specific disease or condition.

Conditions that might qualify include:

- Obesity diagnosed as a disease (not just being overweight)

- Heart disease requiring supervised cardiac rehabilitation

- Diabetes management requiring prescribed exercise therapy

- Arthritis requiring aquatic therapy or specific movement programs

- Chronic conditions where exercise is part of prescribed treatment

Critical requirements:

- Written prescription from a licensed physician

- Documentation showing the gym membership directly treats the diagnosed condition

- Records showing the program is beyond general health maintenance

- Expenses must exceed 7.5% of your adjusted gross income (AGI) to claim the medical expense deduction

Keep in mind that even with a prescription, you can only deduct the portion of costs directly related to treating your condition. If you have a full gym membership but only use the pool for prescribed aquatic therapy, only that specific portion may be deductible.

How to Choose the Right Health Insurance for Cosmetic Surgery (2025 Guide)

2. Self-Employed Business Expense

Self-employed individuals and business owners have more flexibility with fitness-related deductions, but there are strict rules.

Your gym membership might qualify as a business expense if:

- You’re a fitness professional (personal trainer, yoga instructor, group fitness teacher)

- The membership is necessary for continuing education or maintaining certifications

- You use the facility primarily for business purposes (teaching classes, training clients)

- You can demonstrate a direct connection between the membership and income generation

For example, a certified personal trainer who maintains a gym membership to stay current with equipment, teach classes, or train clients can likely deduct this as a legitimate business expense. However, a graphic designer who goes to the gym to “stay energized for work” cannot.

3. Employee Benefits and Workplace Wellness

If you’re an employer rather than an employee, you have options for providing fitness benefits that offer tax advantages:

For Employers:

- Providing on-site fitness facilities for employees is generally tax-deductible as a business expense

- Subsidizing gym memberships as part of a workplace wellness program may be deductible

- These can be structured as de minimis fringe benefits in some cases

For Employees:

- Generally, gym memberships paid by your employer are considered taxable income to you

- However, on-site gym facilities provided by your employer are typically tax-free benefits

- Some companies offer these through cafeteria plans or Health Savings Accounts (HSAs)

4. Entertainment and Client Relations (Mostly Eliminated)

Before the Tax Cuts and Jobs Act of 2017, business owners could sometimes deduct gym memberships used for entertaining clients or business development. These deductions have been largely eliminated for expenses after 2017, so don’t count on this approach unless tax laws change significantly.

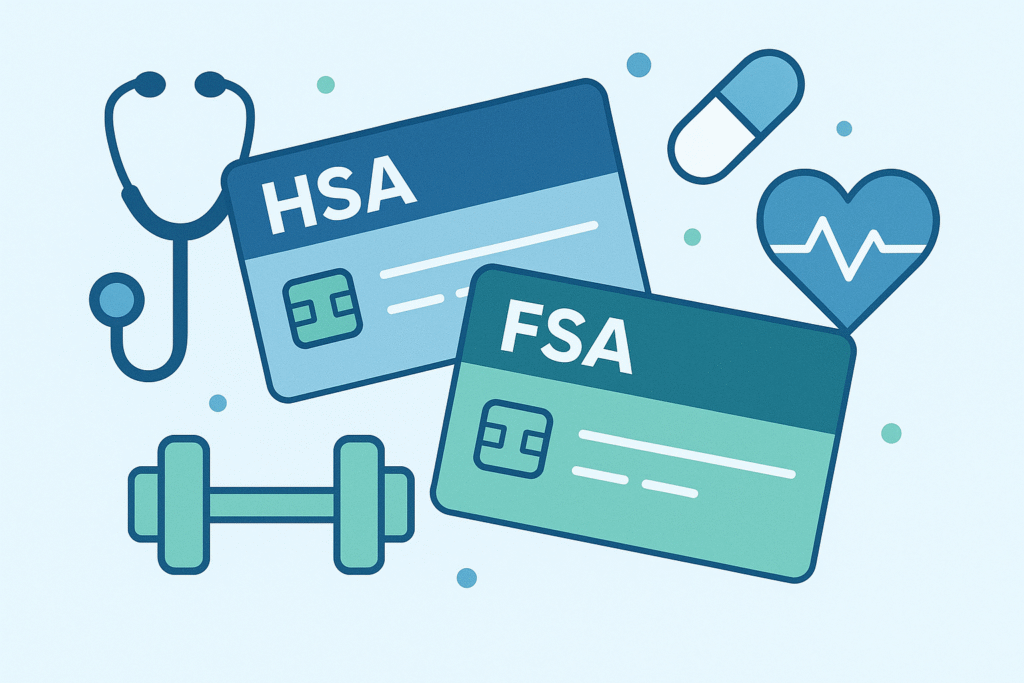

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

While gym memberships themselves typically don’t qualify, HSAs and FSAs offer indirect opportunities for fitness-related tax savings:

What Generally Doesn’t Qualify:

- Standard gym memberships for general fitness

- Fitness classes for general wellness

- Personal training for weight loss alone

What Might Qualify:

- Medically necessary weight-loss programs prescribed by a doctor

- Specific therapeutic programs (physical therapy, cardiac rehab)

- Medical equipment recommended by your physician

Always check with your HSA/FSA administrator, as some programs have expanded to include wellness expenses in recent years.

How to Document Potential Gym Membership Deductions

If you believe your situation qualifies for a deduction, meticulous documentation is essential. The IRS requires proof, and auditors look closely at health and fitness deductions because they’re commonly misunderstood or misused.

Essential Documentation:

- Physician’s Letter or Prescription – Detailed note explaining your diagnosis, why the gym membership is medically necessary, and how it treats your specific condition

- Medical Records – Documentation of your diagnosed condition from medical professionals

- Gym Membership Contracts – Keep all contracts, receipts, and payment records

- Usage Logs – If only partially deductible, maintain logs showing dates and purposes of gym visits related to your medical treatment

- Business Records – For business deductions, maintain detailed records showing business use, income generated, and how the membership relates to your profession

Alternative Tax-Advantaged Ways to Invest in Fitness

Even if you can’t deduct your gym membership directly, consider these alternatives that offer tax benefits:

Employer Wellness Programs

Many employers offer pre-tax payroll deductions for wellness programs or gym subsidies. While not a deduction, paying with pre-tax dollars reduces your taxable income.

Health Reimbursement Arrangements (HRAs)

Some employers offer HRAs that may cover preventive care or wellness programs. Check your plan details.

Medical Tourism for Specialized Programs

Comprehensive weight-loss programs or specialized medical fitness programs that include housing and treatment might qualify as deductible medical expenses if prescribed.

Home Gym Equipment

If you have a medical prescription for specific exercise equipment, that equipment may be more clearly deductible than a general gym membership.

Common Myths About Gym Membership Tax Deductions

Let’s clear up some widespread misconceptions:

Myth: “My doctor says I should exercise, so my gym membership is deductible.” Reality: General recommendations aren’t enough. You need a specific prescription for a diagnosed condition.

Myth: “I work from home, so my gym keeps me productive. It’s a home office expense.” Reality: The home office deduction doesn’t extend to gyms unless you’re a fitness professional using it for business.

Myth: “I can deduct anything related to my health.” Reality: The IRS distinguishes between medical treatment and general wellness.

Myth: “Personal trainers can always write off their own gym memberships.” Reality: Only if they use the membership primarily for business purposes (teaching, maintaining certifications, etc.).

State-Specific Considerations

Federal tax law governs most deduction rules, but some states offer additional incentives or have different interpretations. A few states have explored wellness tax credits or deductions as part of healthcare reform efforts. Check with a local tax professional familiar with your state’s specific tax code.

What the Future Might Hold

Tax policy evolves, and there’s ongoing discussion about expanding deductions for preventive health measures. Some advocacy groups argue that incentivizing fitness could reduce long-term healthcare costs. While no major changes are currently law, it’s worth staying informed about tax legislation that might affect fitness-related deductions.

The Bottom Line: Should You Attempt This Deduction?

For most people, the answer is no—your gym membership won’t be deductible, and attempting to claim it could trigger an audit or penalties for improper deductions.

However, if you genuinely qualify under one of the scenarios outlined above, claiming the deduction is your legal right. The key is honest assessment and thorough documentation.

Before claiming any fitness-related tax deduction:

- Consult with a qualified tax professional or CPA

- Gather all required documentation

- Ensure you meet the specific IRS requirements for your situation

- Keep detailed records in case of audit

- Consider whether the potential deduction justifies the paperwork and risk

Remember, your health and fitness are valuable investments regardless of tax implications. Don’t let tax considerations alone drive your fitness decisions—the real return on investment comes from improved health, energy, and quality of life.

Frequently Asked Questions (FAQs)

Q: Can I deduct my Peloton or home gym equipment? A: Like gym memberships, home fitness equipment is generally not deductible for general fitness. However, if prescribed by a doctor to treat a specific medical condition, it may qualify as a medical expense deduction.

Q: What if I’m a fitness influencer or content creator? A: If you create fitness content professionally and earn income from it, your gym membership and fitness expenses may be deductible as business expenses. You’ll need to demonstrate that these expenses are ordinary and necessary for your income-generating activities.

Q: Can I use my Health Savings Account (HSA) for gym memberships? A: Typically no. Standard HSA rules don’t allow gym memberships unless they’re part of a prescribed medical treatment program. However, some employers offer HSA-compatible wellness programs that might include fitness components.

Q: Are weight-loss programs ever deductible? A: Yes, but only if prescribed by a doctor to treat a specific disease such as obesity, hypertension, or heart disease. General weight-loss programs for appearance or wellness aren’t deductible.

Q: What happens if I claim a gym membership deduction incorrectly? A: If the IRS audits your return and determines the deduction was improper, you may owe back taxes plus interest and potentially penalties. Always consult a tax professional if you’re uncertain.

Q: Can I deduct yoga or Pilates classes? A: The same rules apply as gym memberships. Unless prescribed by a doctor to treat a specific medical condition, these classes are considered personal expenses and aren’t deductible.

Q: Do fitness professionals need to use their gym exclusively for business to deduct it? A: No, but you must use it primarily for business purposes and can only deduct the business-use portion. Keep detailed logs of business versus personal use.

External Resources

For more information about tax deductions and fitness expenses, consult these authoritative sources:

- IRS Publication 502 (Medical and Dental Expenses): https://www.irs.gov/publications/p502 – Official IRS guidance on what medical expenses qualify for deductions

- IRS Publication 535 (Business Expenses): https://www.irs.gov/publications/p535 – Information about deducting business expenses for self-employed individuals

- Healthcare.gov: https://www.healthcare.gov/ – Information about health savings accounts and related programs

- American Institute of CPAs (AICPA): https://www.aicpa.org/ – Find qualified tax professionals and additional tax guidance

Disclaimer: This article provides general information about tax deductions and should not be considered professional tax advice. Tax laws are complex and change frequently. Always consult with a qualified tax professional, CPA, or tax attorney about your specific situation before claiming any deductions on your tax return.