Insurance Coverage for Weight Loss Programs: What You Should Know

Losing weight isn’t just about looking better—it’s often about improving health and preventing serious conditions like diabetes, heart disease, and sleep apnea. Because of the medical importance of weight management, many people wonder:

👉 Does health insurance cover weight loss programs?

The answer: Sometimes, yes—but coverage depends on your plan, provider, and medical necessity.

This article explains how insurance coverage works for weight loss programs, what’s typically included, how to get approval, and what alternatives exist if coverage is limited.

Why Insurance Coverage Matters

Weight loss programs can be expensive. A medically supervised plan can cost hundreds or even thousands of dollars per year. Without insurance, many people skip treatment or settle for less effective methods.

Insurance coverage helps by:

- Making evidence-based treatments affordable.

- Supporting long-term weight management rather than quick fixes.

- Reducing future health costs for obesity-related conditions.

In fact, studies show that treating obesity early saves insurers (and patients) money in the long run.

1. When Do Insurers Cover Weight Loss Programs?

Most insurance companies require proof that weight loss is medically necessary before covering costs.

Common criteria include:

- BMI (Body Mass Index): Usually BMI ≥ 30 (obesity) or ≥ 27 with related health conditions (e.g., high blood pressure, type 2 diabetes).

- Medical necessity letter: From your doctor explaining why weight loss treatment is needed.

- Failed past attempts: Documentation of unsuccessful weight loss efforts through diet and exercise.

Example: A patient with BMI 35 and sleep apnea may qualify for coverage of a medically supervised weight loss program.

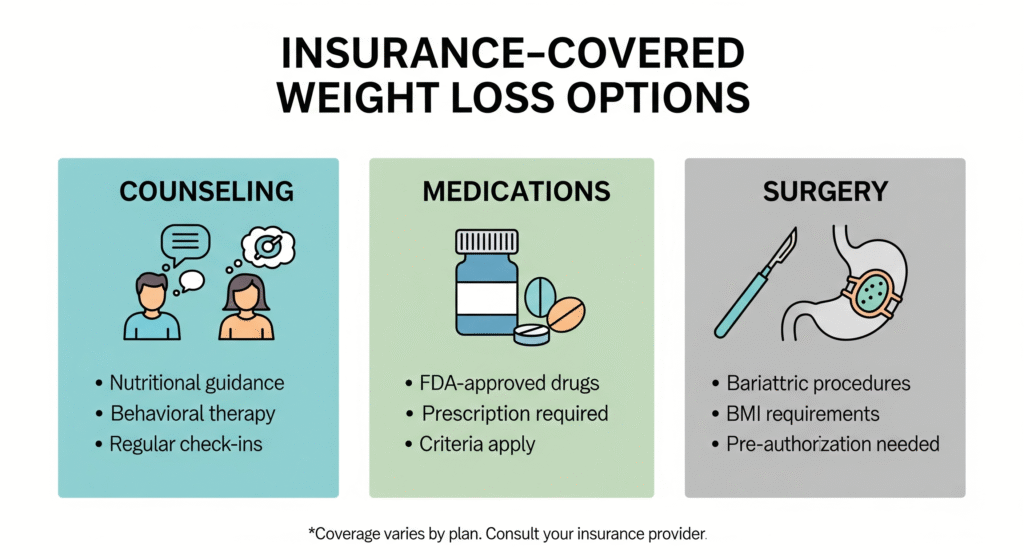

2. What Types of Weight Loss Programs Are Covered?

Insurance usually covers clinically supervised programs over commercial diet plans.

a) Nutrition Counseling & Dietitian Visits

- Often covered if prescribed by a physician.

- Usually limited to a set number of visits per year.

- Can help patients learn portion control, calorie management, and healthier eating habits.

b) Behavioral Therapy

- Includes counseling, habit tracking, and support groups.

- Some insurers cover group or individual behavioral sessions.

c) Medically Supervised Programs

- Run by doctors or hospitals.

- May include physician visits, blood work, and structured diet/exercise plans.

- Typically covered when linked to medical conditions like diabetes or heart disease.

d) Prescription Medications for Weight Loss

- Medications like Wegovy (semaglutide) or Contrave may be covered.

- Insurers usually require prior authorization and proof of medical necessity.

e) Bariatric Surgery (in severe cases)

- Gastric bypass, gastric sleeve, or lap-band surgery.

- Usually covered if BMI ≥ 40 or ≥ 35 with obesity-related health conditions.

- Requires documented failed attempts at non-surgical weight loss.

💡 Not typically covered: Commercial diet programs like Weight Watchers, Jenny Craig, or fitness apps—unless paired with medical supervision.

3. What Insurance Usually Doesn’t Cover

Even when insurance does cover weight loss, some exclusions are common:

- Gym memberships.

- Over-the-counter supplements or diet pills.

- Meal replacement shakes (unless medically prescribed).

- Commercial diet programs not prescribed by a doctor.

4. How to Find Out if Your Plan Covers Weight Loss Programs

Step 1: Review Your Policy

Check your insurer’s benefits handbook or online portal. Look for terms like:

- Medical nutrition therapy

- Obesity treatment

- Bariatric surgery

Step 2: Contact Member Services

Call your insurance company and ask specifically:

- “Do you cover medically supervised weight loss programs?”

- “Are prescription weight loss drugs included in my plan?”

- “Do I need prior authorization or referrals?”

Step 3: Ask Your Doctor for Documentation

Doctors can submit the necessary paperwork to prove medical necessity, which increases your chance of approval.

5. How Medicare & Medicaid Handle Weight Loss Coverage

- Medicare: Covers intensive behavioral therapy for obesity (BMI ≥ 30) when provided by a primary care doctor. Covers bariatric surgery if medical criteria are met.

- Medicaid: Coverage varies by state, but many states cover nutrition counseling, prescription drugs, and bariatric surgery.

👉 For exact benefits, check your state’s Medicaid website or call your plan provider.

6. Tips for Getting Coverage Approved

- Keep records of previous weight loss attempts (diets, exercise plans, medications).

- Get a referral from your doctor.

- Ask about prior authorization requirements.

- Appeal denials—many first claims are denied, but appeals with more documentation succeed.

7. Alternatives If Insurance Doesn’t Cover

Not all insurance plans offer comprehensive coverage. If yours doesn’t, consider:

- Employer wellness programs: Some companies offer weight loss incentives or reimbursements.

- Health savings accounts (HSA/FSA): You may be able to use pre-tax dollars for medically necessary weight loss expenses.

- Community resources: Local hospitals or clinics sometimes offer free or low-cost programs.

8. Real-Life Example

Case study: Sarah, age 42, had a BMI of 34 and high blood pressure. Her doctor recommended a supervised weight loss program.

- Insurance required proof of medical necessity.

- Sarah submitted records of past diet attempts.

- Insurance approved 12 sessions with a dietitian + coverage for Wegovy prescription.

- Within 9 months, she lost 35 pounds, reduced her blood pressure, and avoided more costly medications.

Keto Diet for Beginners: A Complete Guide

FAQs

Q1: Does insurance cover Weight Watchers or Noom?

A: Typically no, unless prescribed and integrated into a doctor-supervised program.

Q2: Will my insurance cover weight loss surgery?

A: Most insurers cover bariatric surgery if strict criteria are met (BMI ≥ 40 or ≥ 35 with comorbidities).

Q3: Are weight loss medications covered?

A: Some are, but prior authorization is almost always required. Coverage depends on your plan.

Q4: Do I need a referral to see a dietitian?

A: Often yes. Many plans require a doctor’s referral for nutrition counseling to be covered.

Q5: Can I appeal if my claim is denied?

A: Absolutely. Submit additional medical documentation and ask your doctor to support the appeal.

External Resources (Trusted References)

- Centers for Medicare & Medicaid Services (CMS) — Obesity Coverage Information

- American Society for Metabolic and Bariatric Surgery — Insurance FAQs

- National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) — Weight Management Resources

- Harvard Health Publishing — Prescription Weight Loss Medications

Final Thoughts

Insurance coverage for weight loss programs can make the difference between getting the help you need and struggling alone. While coverage isn’t guaranteed, knowing your options, understanding medical necessity, and working with your doctor greatly increase your chances of approval.

If your insurance doesn’t cover weight loss treatments, don’t give up—alternative programs, employer benefits, and community resources can help you stay on track.

Your health is worth the effort, and with the right strategy, you can access affordable, effective weight loss support.