Loan for Gym: How to Finance Your Fitness Business in 2025

Starting a gym is an exciting business idea—but it’s also a big financial commitment. Whether you’re opening a small personal training studio, a boutique fitness club, or a full-scale commercial gym, the costs can add up quickly. From leasing space and buying equipment to hiring staff and marketing your services, you may need significant funding to turn your dream into reality.

That’s where a loan for a gym comes in. In 2025, fitness entrepreneurs have more financing options than ever before, ranging from small business loans to equipment financing and even government-backed programs. The key is understanding what types of loans are available, what lenders look for, and how to choose the best option for your gym.

This detailed guide will walk you through everything you need to know about gym loans—including costs, loan types, eligibility, and tips for securing funding.

Why Do You Need a Loan for a Gym?

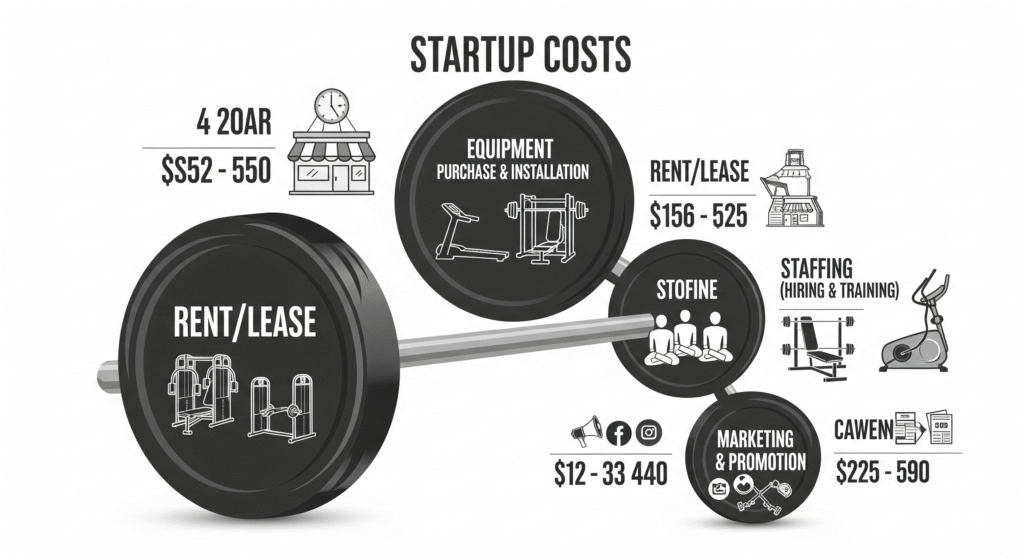

Running a gym requires upfront investment and ongoing working capital. Here are the most common expenses a gym loan can cover:

- Equipment Purchases: Treadmills, weights, resistance machines, and mats can cost tens of thousands of dollars.

- Real Estate Costs: Leasing or buying space for your gym is one of the biggest expenses.

- Renovation & Interiors: Flooring, mirrors, showers, and locker rooms all require funds.

- Licensing & Insurance: Every gym needs permits and liability insurance.

- Staff Salaries: Trainers, receptionists, and maintenance staff need to be paid.

- Marketing & Branding: From signage to social media ads, promotion is crucial for attracting members.

Types of Loans for Gyms in 2025

Not all loans are created equal. Depending on your business size and needs, different financing options may be suitable.

1. Small Business Administration (SBA) Loans

- Backed by the U.S. government.

- Competitive interest rates (usually lower than traditional loans).

- Longer repayment terms (up to 25 years for real estate).

- Good for established gyms with strong financials.

👉 Example: An SBA 7(a) loan can cover working capital, equipment, and real estate.

2. Traditional Bank Loans

- Require strong credit and collateral.

- Offer larger loan amounts but involve strict approval processes.

- Good for gym owners with solid business plans and financial history.

3. Equipment Financing

- Loan specifically for purchasing fitness machines and equipment.

- The equipment itself acts as collateral.

- Easier to qualify for, even with limited credit history.

4. Business Line of Credit

- Works like a credit card for your business.

- Flexible borrowing—you only pay interest on what you use.

- Great for covering seasonal slowdowns or unexpected costs.

5. Merchant Cash Advances (MCA)

- Advance money based on future credit card sales.

- Fast approval but higher interest rates.

- Useful for gyms with steady member subscriptions.

6. Microloans

- Smaller loans (up to \$50,000).

- Offered by nonprofits and community lenders.

- Ideal for small or niche fitness studios.

How Much Does It Cost to Start a Gym in 2025?

The cost depends on the type and size of your gym.

- Small Studio Gym: \$15,000 – \$75,000

- Mid-Sized Gym: \$100,000 – \$500,000

- Full-Scale Commercial Gym: \$500,000 – \$1 million+

These estimates cover rent, equipment, staffing, and marketing. Having a loan makes these numbers more manageable.

Insurance Coverage for Weight Loss Programs: What You Should Know in 2025

What Do Lenders Look for in Gym Loan Applications?

To increase your chances of approval, prepare these key requirements:

- Business Plan: Include revenue projections, target market, and growth strategies.

- Credit History: A strong personal and business credit score improves approval chances.

- Collateral: Some lenders require assets as security.

- Cash Flow Statements: Show you can repay the loan.

- Experience in the Fitness Industry: Demonstrates commitment and expertise.

Steps to Apply for a Loan for Your Gym

- Assess Your Financing Needs – Calculate how much you actually need and what it will cover.

- Check Your Credit Score – Improve your credit before applying if needed.

- Create a Strong Business Plan – Lenders want to see a clear path to profitability.

- Compare Loan Options – Don’t settle for the first offer; compare interest rates and terms.

- Prepare Documentation – Financial statements, tax returns, business licenses.

- Apply & Wait for Approval – Some loans (like MCAs) approve in days, while SBA loans take weeks.

Pros & Cons of Taking a Loan for Your Gym

✅ Pros

- Access to necessary capital.

- Ability to start or expand faster.

- Build business credit for future financing.

❌ Cons

- Interest and repayment obligations.

- Risk of debt if the business struggles.

- Collateral may be required.

Tips to Improve Loan Approval Chances

- Maintain good personal credit.

- Reduce existing debts.

- Offer collateral when possible.

- Show strong membership growth potential.

- Work with lenders experienced in fitness businesses.

Final Thoughts

Getting a loan for your gym can be the key to turning your fitness business dream into reality in 2025. Whether you’re starting fresh or expanding an existing studio, financing options like SBA loans, equipment financing, and business lines of credit can give you the support you need.

The secret to success? A well-thought-out business plan, responsible borrowing, and a clear repayment strategy. With the right funding and preparation, you can build a gym that not only helps people get healthier but also grows into a profitable business.

FAQs About Gym Loans

1. How hard is it to get a loan for a gym?

It depends on your credit score, financial history, and business plan. SBA and equipment loans are often easier to secure for new businesses.

2. Can I get a loan if I don’t have experience in running a gym?

Yes, but lenders may be cautious. Partnering with an experienced manager or showcasing industry research can help.

3. How long does it take to get approved?

Bank and SBA loans can take weeks, while merchant cash advances or online lenders may approve in 1–5 days.

4. Do I need collateral for a gym loan?

Not always. Equipment financing uses the machines as collateral, while SBA loans may require additional security.

5. What’s the best loan for a small fitness studio?

Microloans and equipment financing are great for smaller setups with lower costs.